Sweeping Rules

Automate fund transfers between accounts to maintain optimal balances and streamline cash management.

Automate internal fund movements. Sweeping rules automatically transfer funds between accounts—typically from subsidiary accounts to a primary account—to optimize cash management and maintain target balances.

The Sweeping Rules tab lets you create multiple sweeping rules across different accounts. There is no limit to how many rules you can configure, and you can edit or delete them at any time.

Sweep Actions

There are two types of sweep actions:

- Drawdown – When the balance of the target account exceeds the trigger balance, funds are transferred from the target account to the supporting account to reach the defined target balance.

- Top-up – When the balance of the target account falls below the trigger balance, funds are transferred from the supporting account to the target account to reach the defined target balance.

Avoiding small, unnecessary transfers Add a margin to the trigger balance to avoid moving trivial amounts. For example, if the target balance is 1,000,000 SEK and the actual balance is 1,000,001 SEK, a margin prevents a 1 SEK transfer—saving unnecessary transaction costs.

Frequency & Time

Choose how often and when Atlar checks the target account balance:

- Every 15 minutes – The balance is checked every 15 minutes, and a sweep may occur at that frequency depending on how often your bank updates balances.

- Daily – The balance is checked once per day at a chosen time, and a sweep occurs if the conditions are met.

- Weekly– The balance is checked on specific days of the week and chosen time, and a sweep occurs if the conditions are met.

- Monthly – The balance is checked on specific days of the month and chosen time, and a sweep occurs if the conditions are met.

Configuring Sweeping Rules

Follow these steps to create a new sweeping rule:

- Navigate to Payments → Sweeping Rules.

- In the top-right corner, click Actions → Create New.

- Fill in the required details:

- Target balance account – The account whose balance should be maintained.

- Supporting account – The account used to fund or receive excess funds.

- Target balance – The desired balance to maintain in the target account.

- Action – Choose either drawdown or top-up.

- Trigger – Define the condition: greater than (for drawdown) or less than (for top-up).

- Balance type – Choose between Booked balance or Available balance.

- Frequency and Day – Choose between every 15 minutes, daily, weekly or monthly. Choose the Day if weekly or monthly was chosen.

- Time and Timezone – The time at which Atlar will check the target account balance.

- Payment scheme – Depending on the accounts, different credit transfer schemes may be available.

- Click Create to save the rule.

Tip: To review sweep history, double-click a sweeping rule and open the Sweeps tab for a detailed log.

Sweeping Rule Examples

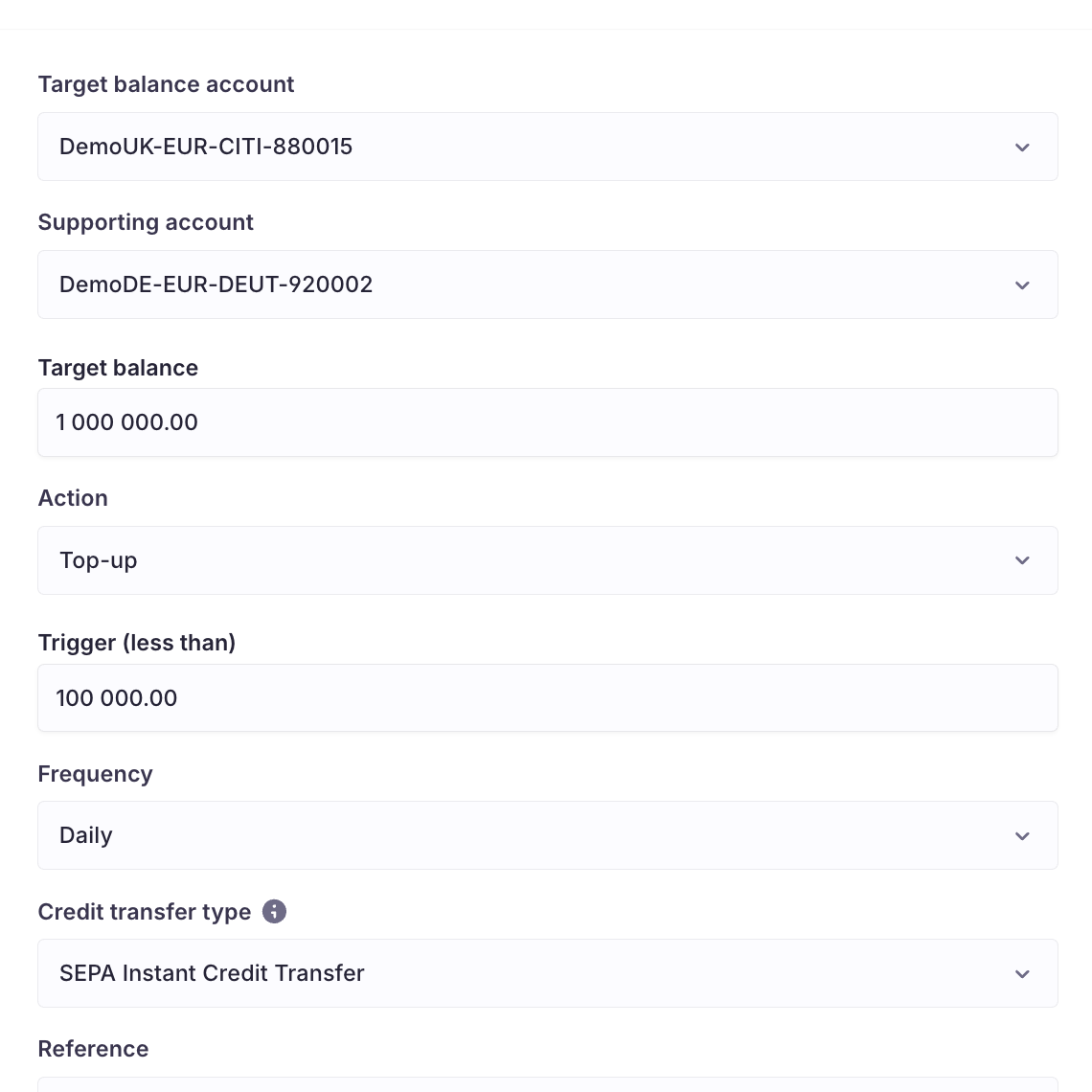

Top-up

When the balance on the target account DemoUK-EUR-CITI-880015 falls below the trigger balance of 100,000 EUR, funds are transferred from the supporting account DemoDE-EUR-DEUT-920002 to restore the target account to a balance of 1,000,000 EUR.

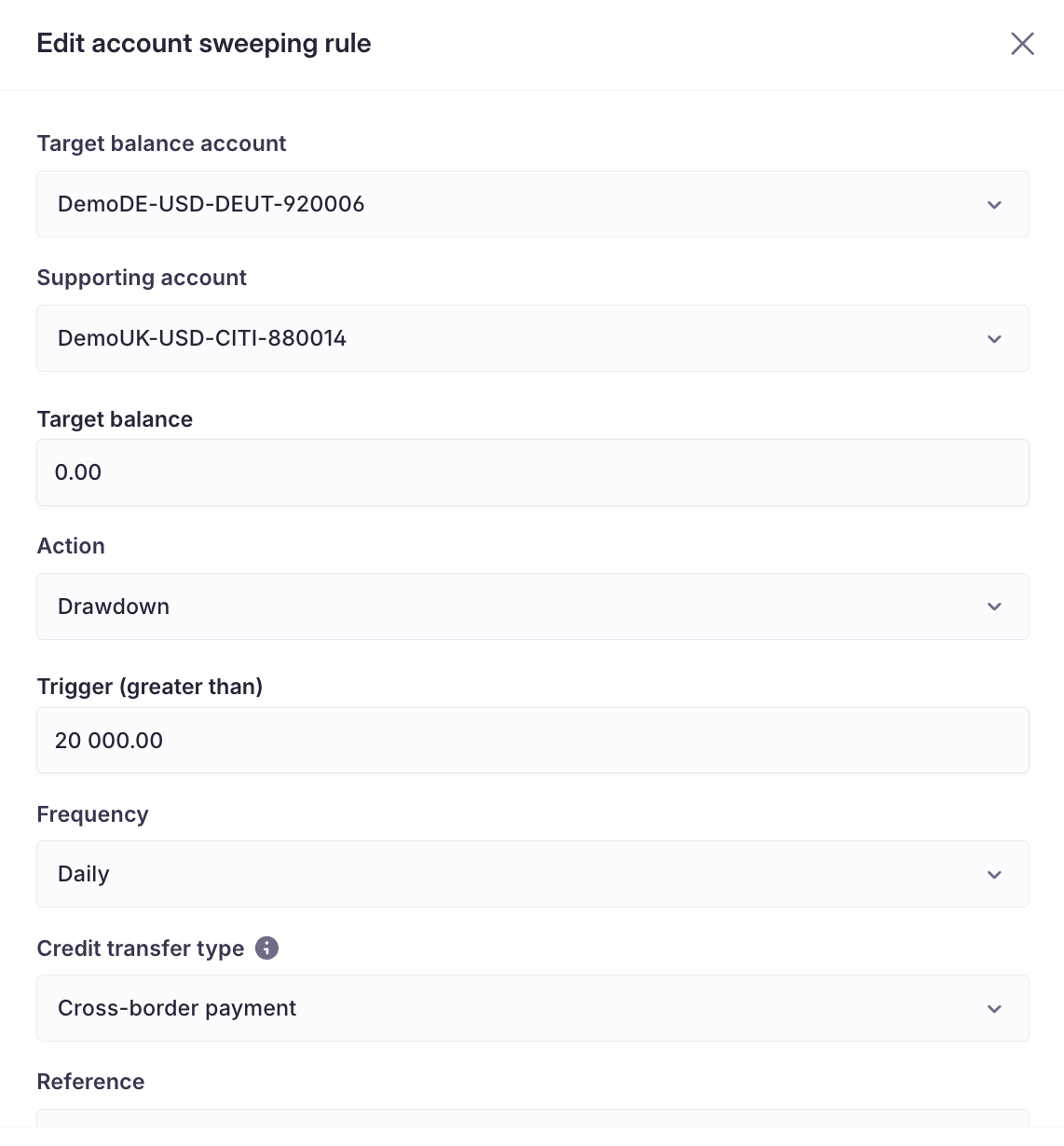

Drawdown

When the balance on the target account DemoDE-USD-DEUT-920006 exceeds the trigger balance of 20,000 USD, the surplus is transferred to the supporting account DemoUK-USD-CITI-880014 to reduce the target account down to a balance of 0 USD.

Updated 4 months ago